Major Changes in Payroll calculations in Rwanda 2025

Published on 20 Jan 2025

Understanding the Impact on Net Salaries and Employer Costs

Starting January 2025, Rwanda is set to implement significant changes to its payroll system. Among these changes is the revised pension contribution rate managed by the Rwanda Social Security Board (RSSB). This adjustment directly impacts both employees' net salaries and employers' payroll budgets. In this article, we’ll explore how the new RSSB rates work, provide practical examples of payroll calculations, and offer insights into how employees and employers can adapt to these changes.

Major Changes in the Pension System

The reforms bring sweeping updates to the current pension system, which has remained largely unchanged since 1962. Key updates include:

- Contribution Rate Increase: The contribution rate will double from 6% to 12%, split equally between employers and employees. This adjustment is critical for addressing the rising life expectancy in Rwanda, which now stands at nearly 70 years.

- Expanded Contribution Base: The pension base will now include transport allowances, aligning with the tax base and ensuring contributions reflect total gross earnings. This alignment simplifies administration and ensures equitable contribution practices.

- Gradual Increment to 20%: From 2027 to 2030, the rate will increase by 2% annually, eventually reaching 20%. While this presents short-term challenges, the long-term benefits include significantly improved retirement savings.

Benefits for Retirees

The reform aims to ensure retirees are better equipped to handle the challenges of post-employment life. Key benefits include:

- Enhanced Benefits for Lower Earners: Current pensioners, particularly those with lower incomes, will see an increase in payouts, addressing cost-of-living concerns.

- Higher Future Payouts: By basing contributions on gross earnings, future retirees will receive higher benefits, ensuring financial stability.

- Sustainability: These measures bolster the system's financial health, ensuring it can meet obligations well into the future.

Impacts on Take-Home Salary

Employers and employees will now contribute 6% each, doubling from the current 3%. Employers have the option to shoulder the increase on behalf of employees, though this flexibility depends on individual business policies. While the increased contributions may initially affect take-home pay, they represent a critical investment in financial security.

Alignment with National Goals

The reforms extend beyond individual benefits, contributing to Rwanda’s broader social and economic objectives:

- Economic Growth: Increased national savings bolster investment opportunities, fostering economic development.

- Social Equality: Enhanced benefits for low earners reduce income inequality, improving overall quality of life.

- Support for Enterprises: Initiatives such as the SME Fund, launching in 2025, aim to provide capital access to small and medium-sized enterprises, driving innovation and growth.

Private Sector Advantages

The reforms introduce a range of opportunities for businesses:

- SME Fund: A Rwf 30 billion fund will enhance capital access, fostering entrepreneurship and innovation.

- Market Liquidity: Additional pension contributions will flow into capital markets, supporting affordable lending and expanding business opportunities.

A Forward-Thinking Approach

By proactively addressing pension sustainability, Rwanda is positioning itself to avoid the crises faced by aging populations in other nations. The reform not only strengthens individual financial security but also contributes to national savings and economic resilience.

As the Rwanda Social Security Board (RSSB) continues to invest in critical sectors, including affordable housing and job creation, these reforms promise to enhance both individual well-being and national prosperity. Though the journey may bring short-term adjustments, the long-term rewards far outweigh the challenges, securing a brighter future for Rwanda and its people.

Implications for Employees: Calculating Net Salary

For employees, an increase in RSSB contributions means a slight reduction in take-home pay (net salary). Here’s how deductions will look under the new system:

Example Calculation for an Employee

Let’s assume:

- Basic salary: RWF 300,000

- Transport Allowance: RWF 40,000

- Housing Allowance: RWF 60,000

- Gross Salaries: RWF 400,000

1. PAYE Calculation (based on Rwanda's progressive tax rates):

- Gross amount from RWF 0 to 60,000: 0% tax = 0 RWF.

- Next RWF 60000 to 100,000: 10% = RWF (100,000-60,000) = 40,000*10% tax = RWF4,000

- Next From 100,000 to 200,000: 20% = RWF (200,000 – 100,000) = 100,000 * 20% = RWF20,000

- Remaining amount above 200,000: 30% = RWF (400,000 – 200,000) = 200,000 * 30% tax = RWF60,000

- Total PAYE = 60,000+20,000+4000=RWF84,000.

2. How to Calculate RSSB Contribution in 2025?

- Pension

- Pension Employee contribution = 6% of gross salary: 400,000*6% = RWF24,000

- Pension Employer contribution = 6% of gross salary: 400,000*6% = RWF24,000

- Occupational hazards

- Occupation hazard (OH) Paid by employer = 2% of gross salary minus transport allowance: (400,000-40,000) *2% = RWF7,200

- Maternity Contributions

- Maternity Employee contribution = 0.3% of gross salary minus transport allowance: (400,000-40,000) *0.3% = RWF1,080

- Maternity Employer contribution = 0.3% of gross salary minus transport allowance: (400,000-40,000) *0.3% = RWF1,080

3. Community-Based Health Insurance (CBHI)

Let’s first of all calculate Net salary before CBHI

Gross Salaries-PAYE-Pension Employee Contribution-Maternity Employee Contribution=

400,000-84,000-24,000-1080=RWF 290,920 *0.5%= RWF1,455

Total RSSB employee contribution (Deductions) =24,000+1080+1455=RWF26535

Total Deductions = (PAYE+RSSB) = RWF110,535

Net Salary:

- Net salary = Gross salary - (RSSB employee contributions + PAYE).

400,000−(84,000 + 26535) = RWF 289,465.

Impact on Net Salary: Previously, with a 3% RSSB contribution, the total deduction would have been RWF 97,401, resulting in a net salary of RWF 302,599. The revised rate reduces the take-home pay by RWF 13,134.

Implications for Employers: Rising Gross Costs

Employers are responsible for covering a larger share of the pension contributions, increasing from 5% to 8% of each employee's gross salary. While this ensures greater security for employees, it raises company payroll expenses.

Example Calculation for RSSB contributions for Employer

Using the same employee with a gross salary of RWF 400,000:

Employer RSSB Contribution:

- Employer contribution = 6% of gross salary plus 2% of (gross Salary minus transport)

- (8%×400,000)+ (400000-4000)*2% = RWF31,200

Total Employer Cost:

- Gross salary + employer RSSB contribution.

- 400,000+24,000+7200= RWF432,280.

Impact on Employer Costs: The previous contribution rate of 5% (RWF 18,000) would have resulted in a total cost of RWF 419,080. The new rate increases employer costs by RWF 13,200 per employee.

A Broader Perspective: Benefits of the Change

While these changes may seem financially burdensome in the short term, they are designed to yield long-term benefits, such as:

Enhanced Retirement Benefits:

Workers will enjoy higher pensions upon retirement, promoting financial independence.

Improved Social Security System:

The increased contributions strengthen Rwanda's social safety net, benefiting society at large.

Encouragement for Long-Term Savings:

Higher deductions instill a culture of saving among employees, preparing them for future needs.

Preparing for Transition: Recommendations

For Employees:

Budget Adjustments:

Plan for a slightly reduced net salary by reassessing monthly expenses.

Understand Your Pay Slip:

Familiarize yourself with the new deduction structure to avoid surprises.

For Employers:

Reevaluate Payroll Budgets:

Prepare for increased costs by incorporating them into 2025 budgets.

Employee Communication:

Clearly explain the benefits of the revised system to employees, emphasizing its long-term advantages.

Seek Efficiency:

Offset rising payroll costs by optimizing other operational expenses.

Common Questions About the 2025 Payroll Changes

1. Will the new rates apply to all employees?

Yes, all employees under RSSB coverage, including formal and informal sectors, will be subject to the new rates.

2. How does the change affect tax obligations?

The PAYE structure remains unchanged. However, the increased RSSB deductions reduce taxable income, slightly lowering tax liability for employees.

3. Are there penalties for non-compliance?

Employers must adhere to the new rates. Failure to comply may result in fines and legal repercussions as stipulated by RSSB regulations.

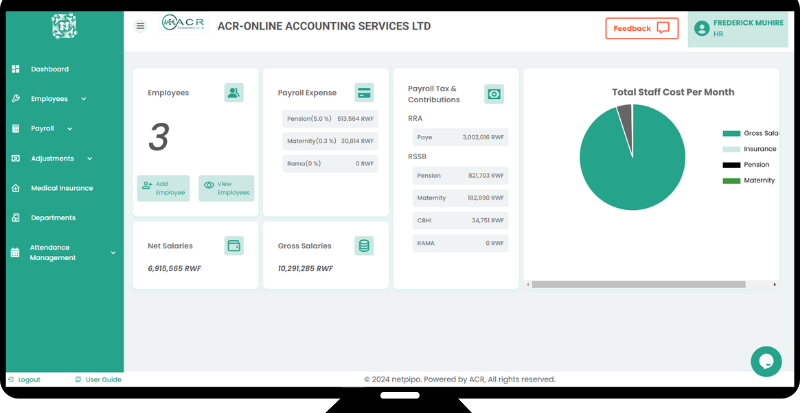

Why Payroll Management Software like Netpipo Is the Ultimate Solution?

The 2025 payroll changes in Rwanda emphasize the need for adaptable, efficient payroll systems. Netpipo’s all-in-one platform offers:

- Accuracy: Automates complex calculations with precision.

- Transparency: Provides employees with clarity about their contributions and net salary.

- Compliance: Keeps businesses aligned with government regulations.

- Efficiency: Reduces administrative burdens for HR and finance teams.

By simplifying payroll management and empowering businesses and employees, Netpipo positions itself as the trusted partner for navigating Rwanda’s payroll transformation.

Embrace the Future AI to automate repeating tasks

Ready to adapt to the 2025 payroll changes effortlessly? Discover how Netpipo can simplify your payroll and HR management while ensuring compliance with the new RSSB rates.

Visit Netpipo today to request a free demo and see how we can transform your payroll experience!

Conclusion:

The 2025 payroll changes in Rwanda mark a step towards a stronger social security system, ensuring better retirement benefits for employees. While the increased deductions may pose initial challenges, both employees and employers can adapt through careful planning and budgeting. By embracing these changes, Rwanda is setting the stage for a more secure financial future for its workforce.